On 26 March 2021, Julia Charlton moderated a virtual roundtable on Listing in London

Julia Charlton moderated a virtual roundtable on Listing in London with great speakers and panellists Tom Attenborough & Jon Edwards of the London Stock Exchange, Andrew Collins & Victoria Younghusband of CRSB & Giles Rolls of Finncap on 26 March 2021.

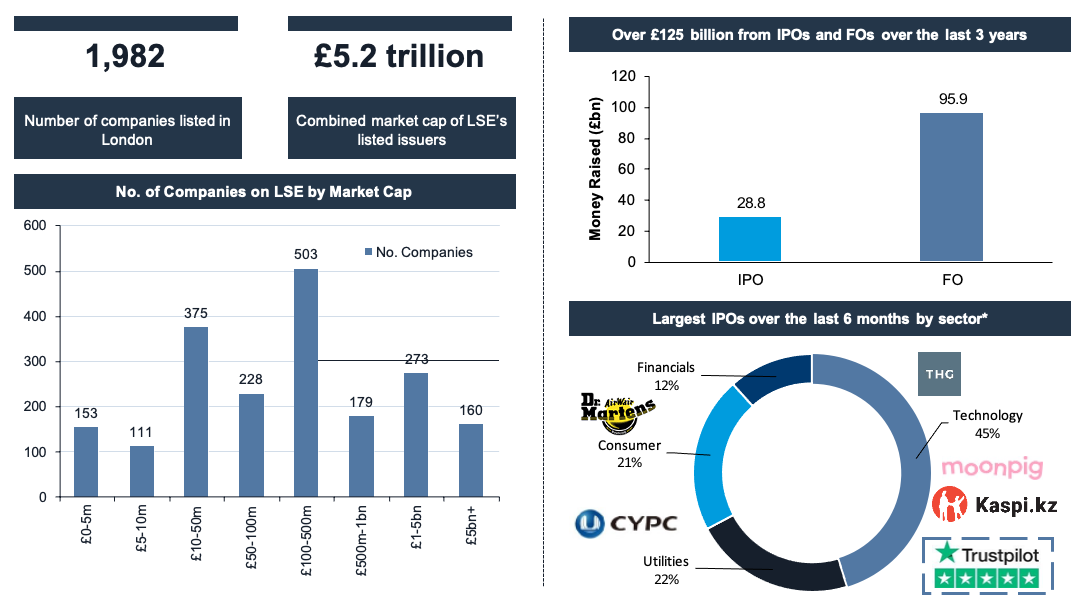

A Snapshot of London Stock Exchange

£5.2 trillion of value with over £125 billion raised since 2018

Source: LSEG, Dealogic, February 2021

*IPOs raising more than £500m

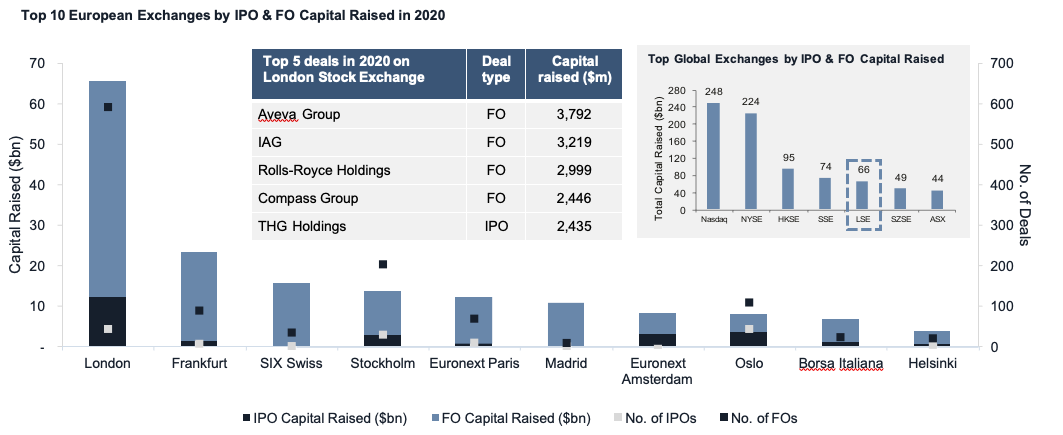

Europe’s Most Active Equity Market

$65.6bn has been raised in London through IPOs & FOs in 2020

London was the most active equity market in Europe in 2020, with:

- 2.7x more transactions (635 IPOs & FOs) than the next most active exchange, Stockholm (231 IPOs & FOs)

- 2.8x more in IPO and FO proceeds ($65.6bn) than the next exchange, Frankfurt ($23.3bn)

Source: Dealogic, January 2021

All calculations are based on a deal pricing date

A Globally Diverse Investment Base

Gain access to the most internationally diverse pool of investment

Domicile of Top investors in listed securities in London*

- 46% UK

- 33% North America

- 15% Europe (ex UK)

- 6% Rest of W orld

- London has the most diverse investor base of any major global exchange, while still allowing issuers to access US institutional investors.

- This allows issuers access to a pool of capital that is comfortable with companies who build internationally facing business models.

Domicile of Top investors in listed securities in the US*

- 85% North America

- 6% UK

- 6% Europe (ex UK)

- 3% Rest of World

|

Largest Institutions Investing in LSE Listed Stock |

Investor Country |

|

BlackRockInvestmentManagement(UK)Ltd. |

United Kingdom |

|

The Vanguard Group, Inc. |

United States |

|

Norges BankInvestmentManagement |

Norway |

|

BlackRock Fund Advisors |

United States |

|

CapitalResearch&ManagementCo. |

United States |

|

SchroderInvestmentManagementLtd. |

United Kingdom |

Source: FactSet, February 2021

*Based on the Value of Securities Held

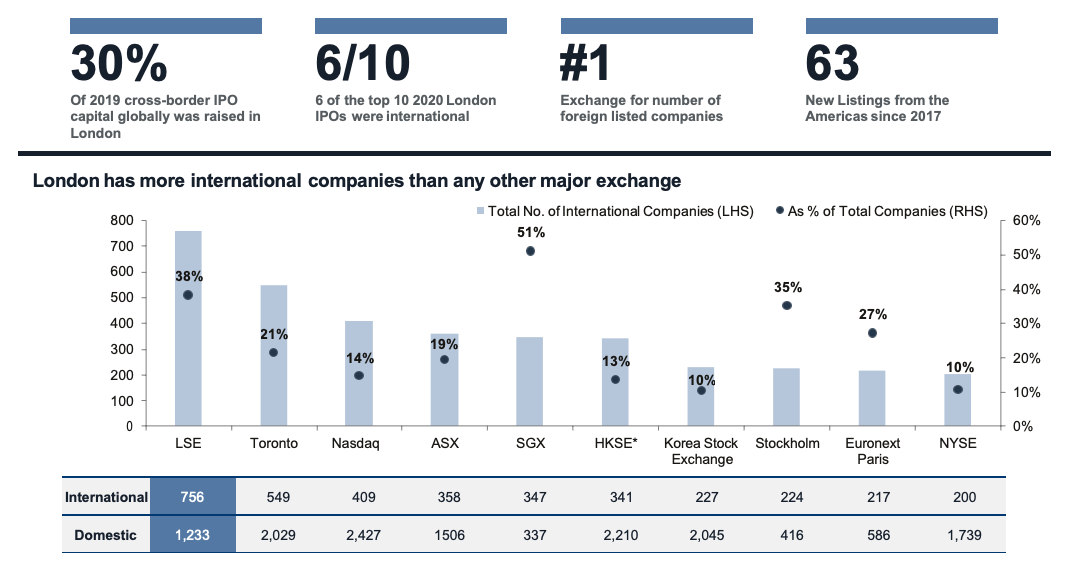

The Home of International Issuers

More international companies choose London for listing

Source: London Stock Exchange, FactSet, March 2021

Note: Chart data as of January 2021. Exchanges w ith fewer than 250 companies listed are excluded. *1530 (60%) of HKSE companies are Chinese — International companies are those where the country of primary business of a company is not equal to the country of its primary listing. Our country of primary business methodology uses FactSet data and takes into account the country of largest revenue exposure, headquarters and incorporation

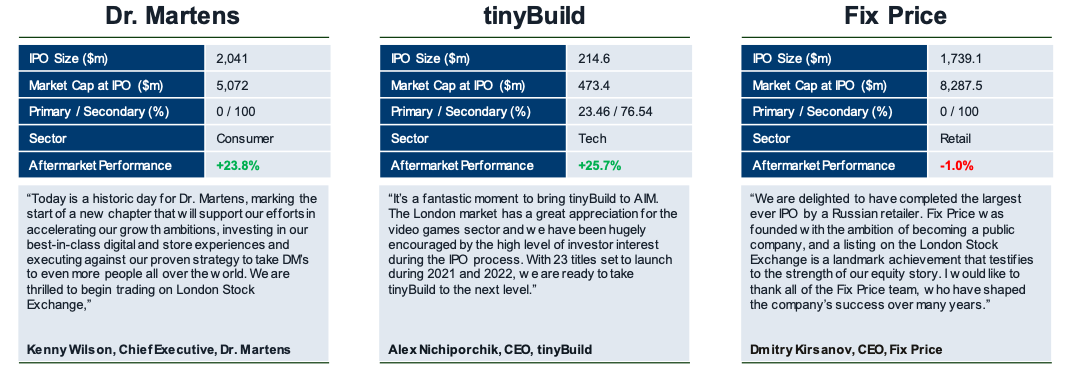

Significant Increase in New Issues

Landmark deals since the start of 2021

Source: LSE, company w ebsite, Dealogic, FactSet, March 2021

A Partnership with Asia Pacific Corporates

Overview of companies listed on LSE

Source: LSE statistics, Dealogic, February 2021

* Countries defined by country of primary business (i.e. primary HQ / revenue / operations) Note: Money raised fromboth IPO and FO are included.

Supporting Chinese Growth

Key access points for Chinese companies across LSEG

- Huatai Securities, the inaugural Stock Connect issuer opening the London market, 17 June 2019

- FTSE Russell leadership celebrating the inclusion of China A shares in global indexes, July 2019

- ICBC celebrating their £600m bond in July 2019, the first ever Chinese bank to issue a sterling denominated bond

- Nikhil Rathi, CEO LSE Plc meets President Xi Jinping, October 2015

Going Public in London

LSE offers four key options to suit companies with different needs

|

|

Premium Main Market |

Standart Main Market |

Hight Growth Segment |

AIM |

|

Usedby |

Companies that want to adhere and benefit from some of the most robust listing requirements and corporate governance standards in the world. |

Companies looking to access London’s investor base and liquiditywhilst complying with baseline regulatoryrequirements found across international markets. |

Younger, high-growth companies that aspire to be on the Premium segment but do not qualify for all of the listing criteria (e.g. free float). |

Smaller and growing companies looking to make an early transition from private to public on a market with a flexible regulatory framework. |

|

Benefits |

|

|

|

|

Note: (1) (majority of which must be raised at IPO. (2) Smaller companies with a higher f ree f loat are permitted to use HGS. (3) Based on audited rev enue f or the last f our y ears

- Tom Attenborough

- Head of International Primary Markets

- London Stock Exchange Plc

- +44 20 7797 3747

- tom.attenborough@lseg.com

- Zhu Liu

- Vice President, Primary Markets

- Zhu.Liu@lseg.com

- Hong Kong

- Jon Edwards

- Chief Representative, Beijing Office

- London Stock Exchange Plc

- +86 10 5811 1911

- jon,edwards@lseg.com

- Sally Tang

- Beijing Representative Office,

- Primary Markets

- Sally.Tang@lseg.com

- Beijing

- Ollie Fox

- Business Development, Primary Markets, South East Asia

- London Stock Exchange Plc

- +65 8740 6567

- ollie.fox@lseg.com

- Singapore

Legal Disclaimer

This document has been compiled by London Stock Exchange plc (the “Exchange”). The Exchange has attempted to ensure that the information in this document is accurate, however the information is provided “AS IS” and on an “AS AVAILABLE” basis and maynot be accurate or up to date.

The Exchange does not guarantee the accuracy, timeliness, completeness, performance or fitness for a particular purpose of the document or any of the information in it. The Exchange is not responsible for any third party content which is set out in this document. No responsibility is accepted by or on behalf of the Exchange for any errors, omissions, or inaccurate information in the document.

No action should be taken or omitted to be taken in reliance upon information in this document. The Exchange accepts no liability for the results of any action taken on the basis of the information in this document.

All implied warranties, including but not limited to the implied warranties of satisfactory quality, fitness for a particular purpose, non-infringement, compatibility, security and accuracy are excluded by the Exchange to the extent that they may be excluded as a matter of law. Further, the Exchange does not warrant that the document is error free or that any defects will be corrected.

To the extent permitted by applicable law, the Exchange expressly disclaims all liability howsoever arising whether in contract, tort (or deceit) or otherwise (including, but not limited to, liability for any negligent act or omissions) to any person in respect of any claims or losses of any nature, arising directly or indirectly from: (i) anything done or the consequences of anything done or omitted to be done wholly or partly in reliance upon the whole or any part of the contents of this document, and (ii) the use of any data or materials in this document.

Information in this document is not offered as advice on any particular matter and must not be treated as a substitute for specific advice. In particularinformation in the document does not constitute professional, financial or investment advice and must not be used as a basis for making investment decisions and is in no way intended, directly or indirectly, as an attempt to market or sell any type of financial instrument. Advice from a suitably qualified professional should always be sought in relation to any particular matter or circumstances.

The contents of this document do not constitute an invitation to invest in shares of the Exchange, or constitute or form a part of any offer for the sale or subscription of, or any invitation to offer to buy or subscribe for, any securities or other financial instruments, nor should it or any part of it form the basis of, or be relied upon in any connection with any contract or commitment whatsoever.

London Stock Exchange and the London Stock Exchange coat of arms device are registered trade marks of London Stock Exchange plc. Other logos, organisations and company names referred to may be the trade marks of their respective owners.

© 2021 London Stock Exchange plc 10 Paternoster Square, London EC4M 7LS, Telephone +44 (0)20 7797 1000, www.lseg.com

Listing in London: a virtual roundtable

Current rules overview

Victoria Younghusband, Partner, Charles Russell Speechlys LLP London and Hong Kong

Giles Rolls, Corporate Finance Associate Director, finnCap

charlesrussellspeechlys.com | finncap.com

Official List – Eligibility

- 25% free float worldwide (no longer just in EEA)

- Whole class of shares to be listed

- Shares freely transferable

- Minimum market cap of £700,000 (for shares)

- Prospectus (vetted and approved by FCA)

Official List – premium listing

- Equity shares only

- Segments

- commercialcompany

- closed-ended investment fund

- open-ended investment company

- sovereign controlled commercial company

- three year track record for 75% of its business

- revenue earnings track record

- relationship agreement where controlling shareholder

- special rules for mineral, property and scientific research companies

- shareholder approval for large transactions and related party transactions

- FTSE Index eligibility

- Sponsor required

Official List premium listing – closed-ended investment funds

- Spread of investment risk

- No significant trading activity (but OK in investment portfolio)

- Clear and sufficiently precise investment policy

- Majority of board must be independent of investment manager

- Sponsor required

Standard listing

- Commercial company or specialist fund segment

- Much less prescriptive

- Currently used for SPACs

- No sponsor requirement

AIM

- No market cap or free float requirement

- AIM Rules for Companies

- Admission Document not prospectus unless “offer to the public”

- Role of Nomad and AIM Regulation

- Special rules for investing companies and oil & gas companies

Ongoing Requirements

- Official List – all segments

- Disclosure Guidance and Transparency Rules

- AIM Rules on reporting and disclosure

- UK Market Abuse Regulation applies to all London markets

- City Code on Takeovers and Mergers

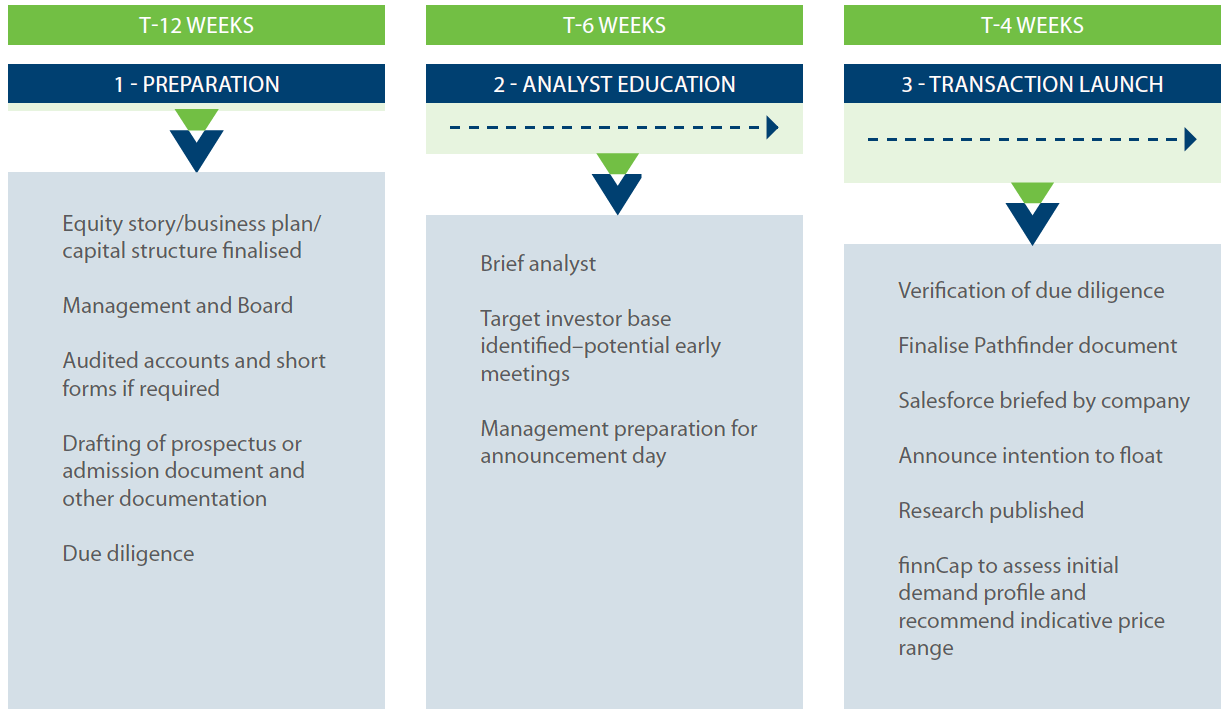

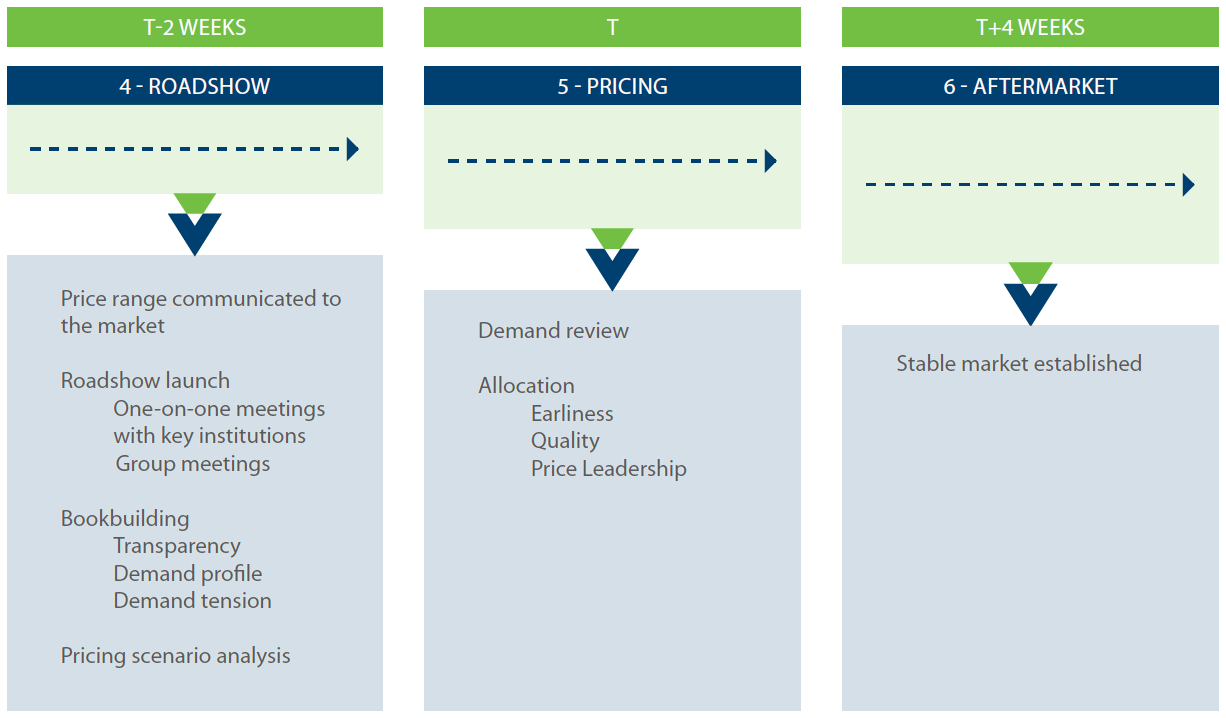

Indicative IPO timetable

Eligibility

Prospectus Review*

KEY DRIVERS: AVAILABILITY OF AUDITED FINANCIALS, EXTENT OF CORPORATE RESTRUCTURING REQUIRED, COMPLETION OF DOCUMENTATION

Corporate Governance Landscape

- The UK Corporate Governance Code (“FRC Code”)

- Applies to all Main Market companies on the Premium List (UK and International)

- Lesser disclosure standards for Standard List companies

- Board Composition requirements:

- Chairman to be independent on appointment

- Need a senior independent NED

- Diversity of experience and gender

- Majority of Independent NEDs

- Predominantly for AIM companies and utilising a ‘comply or explain’ approach

- Applies elements of the FRC Code and other relevant guidance

UK Investors

The UK has a deep pool of capital

- Institutional, wealth manager, retail investors from across the world

What are investors looking for?

-

A great leadership team

- strong track record

- aligned with shareholder s

- strong corporate governance

-

Growth opportunity

- potential to accelerate growth

- ability to capitalise on opportunities (e.g. acquisitions)

-

Clear equity story

- predominantly generalist investors

- Growth/inc ome

- Earnings visibility/Cash generation

- Industry dynamics

- Size/Liquidity

Will UK investors invest in Chinese Companies?

- Important points for considerations:

- Legal jurisdiction and regulatory environment

- Country and political risk

- Tax regime

- Share class and ownership restrictions

- The directors (highly likely that at least one UK director required)